Calculations involving interest rates are usually very easy and

straightforward, but sometimes it involves specific issues that makes

the task of writing structured and reproducible code for it chalenging

and annoying. The fixedincome package brings many functions

to strucutre and create facilities to handle with interest rates, term

structure of interest rates and specific issues regarding compounding

rates and day count rules, for example.

Below there are a few examples on how to create and make calculations

with interest rates using fixedincome.

You can install from CRAN with:

install.packages("fixedincome")You can install the development version of fixedincome from GitHub with:

# install.packages("devtools")

devtools::install_github("wilsonfreitas/R-fixedincome")To create an interest rate we need to specify 4 elements:

simple, discrete or

continuous.actual/360 where the

days between two dates are calculated as the difference and the year is

assumed to be 360 days.actual calendar that compute the difference between

two dates.There is another important topic that wasn’t declared here that is

the frequency of interest. To start with the things simple

fixedincome handles only with annual rates since

this represents the great majority of rates used in financial market

contracts, but this restriction can be reviewed in the future.

Given that let’s declare an annual spot rate with a

simple compounding, an actual/360 and the

actual calendar.

library(fixedincome)

sr <- spotrate(0.06, "simple", "actual/360", "actual")

sr

#> [1] "0.06 simple actual/360 actual"Compound the spot rate for 7 months.

compound(sr, 7, "months")

#> [1] 1.035Also compound using dates.

compound(sr, as.Date("2022-02-23"), as.Date("2022-12-28"))

#> [1] 1.051333Spot rates can be put inside data.frames.

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:fixedincome':

#>

#> first, last

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, union

library(fixedincome)

df <- tibble(

rate = spotrate(rep(10.56 / 100, 5),

compounding = "discrete",

daycount = "business/252",

calendar = "Brazil/ANBIMA"

),

terms = term(1:5, "years")

)

df

#> # A tibble: 5 x 2

#> rate terms

#> <SpotRate> <Term>

#> 1 0.1056 discrete business/252 Brazil/ANBIMA 1 year

#> 2 0.1056 discrete business/252 Brazil/ANBIMA 2 years

#> 3 0.1056 discrete business/252 Brazil/ANBIMA 3 years

#> 4 0.1056 discrete business/252 Brazil/ANBIMA 4 years

#> 5 0.1056 discrete business/252 Brazil/ANBIMA 5 yearsThe tidyverse verbs can be easily used with SpotRate and

Term classes.

df |> mutate(fact = compound(rate, terms))

#> # A tibble: 5 x 3

#> rate terms fact

#> <SpotRate> <Term> <dbl>

#> 1 0.1056 discrete business/252 Brazil/ANBIMA 1 year 1.11

#> 2 0.1056 discrete business/252 Brazil/ANBIMA 2 years 1.22

#> 3 0.1056 discrete business/252 Brazil/ANBIMA 3 years 1.35

#> 4 0.1056 discrete business/252 Brazil/ANBIMA 4 years 1.49

#> 5 0.1056 discrete business/252 Brazil/ANBIMA 5 years 1.65Let’s create a spot rate curve using web scraping (from B3 website)

source("examples/utils-functions.R")

#>

#> Attaching package: 'bizdays'

#> The following object is masked from 'package:stats':

#>

#> offset

curve <- get_curve_from_web("2022-02-23")

curve

#> SpotRateCurve

#> 1 day 0.1065

#> 3 days 0.1064

#> 25 days 0.1111

#> 44 days 0.1138

#> 66 days 0.1168

#> 87 days 0.1189

#> 108 days 0.1207

#> 131 days 0.1220

#> 152 days 0.1227

#> 172 days 0.1235

#> # ... with 29 more rows

#> discrete business/252 Brazil/ANBIMA

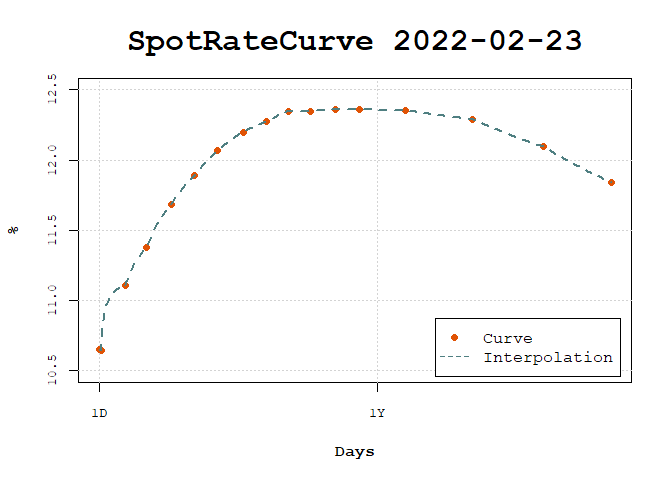

#> Reference date: 2022-02-23SpotRateCurve plots can be easily done by calling

plot.

plot(curve)

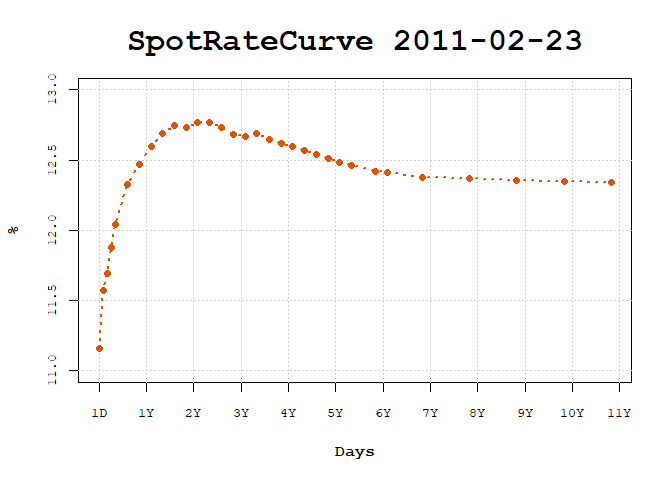

For another date.

curve <- get_curve_from_web("2011-02-23")

plot(curve)

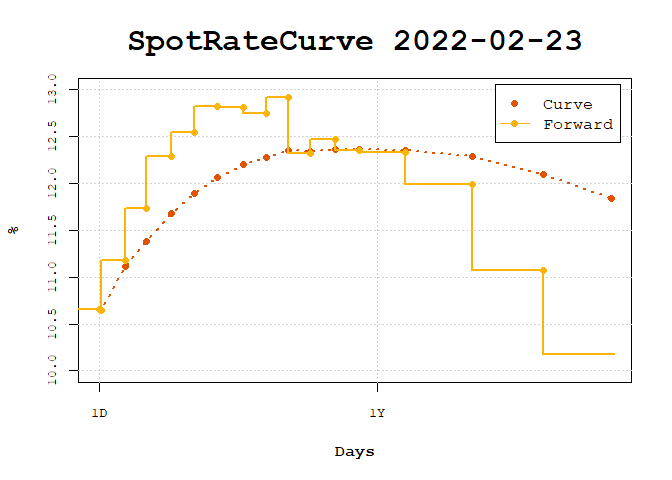

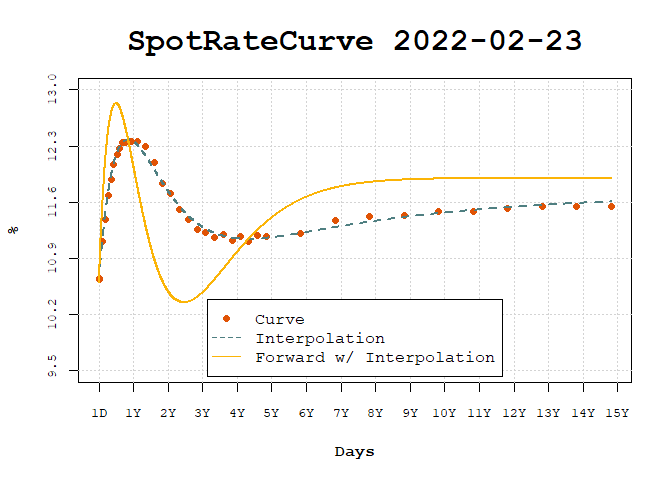

It can show the forward rates for the short term by selecting the first two years.

curve <- get_curve_from_web("2022-02-23")

plot(fixedincome::first(curve, "2 years"), show_forward = TRUE)

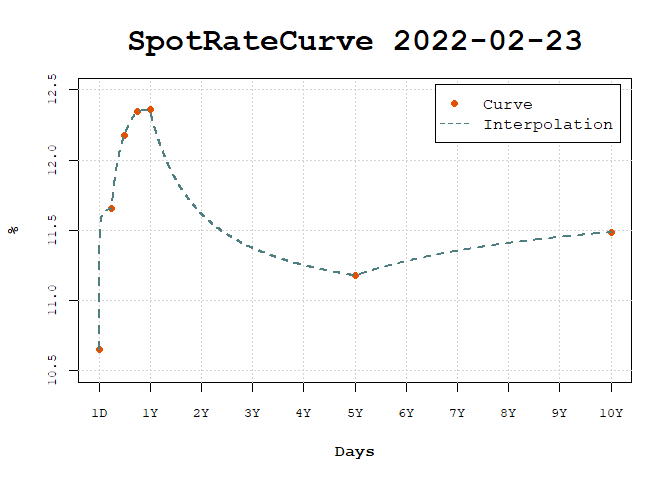

Once interpolation is set, it can be used in the plot.

curve_2y <- fixedincome::first(curve, "2 years")

interpolation(curve_2y) <- interp_flatforward()

plot(curve_2y, use_interpolation = TRUE, legend_location = "bottomright")

Parametric models like the Nelson-Siegel-Svensson model can be fitted to the curve.

beta1 <- as.numeric(fixedincome::last(curve, "1 day"))

beta2 <- as.numeric(curve[1]) - beta1

interpolation(curve) <- fit_interpolation(

interp_nelsonsiegelsvensson(beta1, beta2, 0.01, 0.01, 2, 1), curve

)

interpolation(curve)

#> <Interpolation: nelsonsiegelsvensson >

#> Parameters:

#> beta1 beta2 beta3 beta4 lambda1 lambda2

#> 0.119 -0.013 1.000 -0.975 1.195 1.122Once set to the curve it is used in the plot to show daily forward rates.

plot(curve, use_interpolation = TRUE, show_forward = TRUE, legend_location = "bottom")

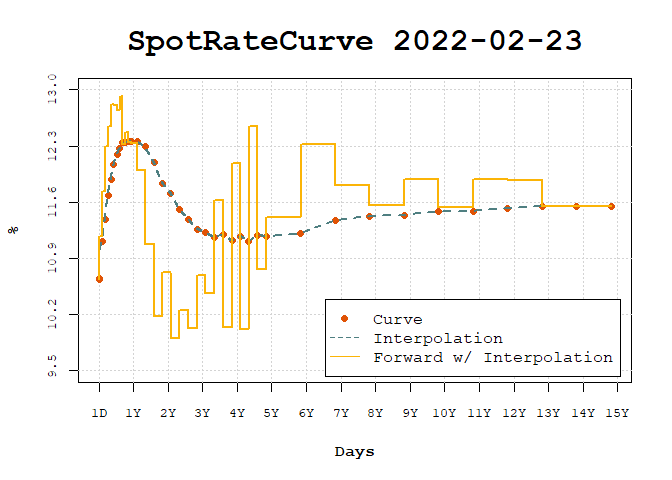

The interpolation can be changed in order to compare different interpolations and the effects in forward rates.

interpolation(curve) <- interp_flatforward()

plot(

curve,

use_interpolation = TRUE, show_forward = TRUE,

legend_location = "bottomright"

)

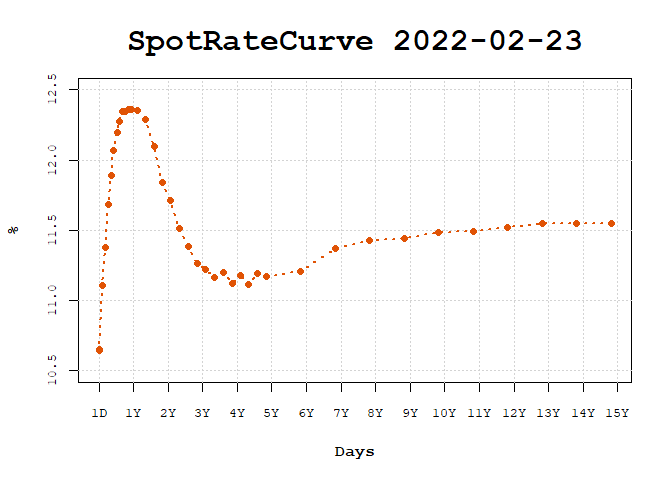

Interpolation enables the creation of standardized curves, commonly used in risk management to build risk factors.

risk_terms <- c(1, c(3, 6, 9) * 21, c(1, 5, 10) * 252)

risk_curve <- curve[[risk_terms]]

interpolation(risk_curve) <- interp_flatforward()

plot(risk_curve, use_interpolation = TRUE)